INVESTMENT BANKING

BUSINESS ADVISORY

INVESTMENT BANKING

FROM '1 to 10'

Fund Raising (>$2Mn)

&

M&A (Corporate/MSME's)

(Equity, Venture Debt, M&A)

BUSINESS ADVISORY

A. Deal Advisory For Funds/Investors

B. Growth Advisory - Startups/MSMEs/Corporates

C. Market Research (Primary - Customers & Experts + Secondary) for B2B / B2C use cases

INVESTMENT BANKING

BUSINESS ADVISORY

Our Vision

"We at Samvedanam Consulting, want to become the preferred integrated growth advisory partner for a growing organization like yours & further supplement your efforts to create a sustainable business and operating model, through leveraging our experienced industry lens!"

Our 4S Integrated Approach Brings In Required Custom Value

SPOT

Your specific advisory needs through detailed direct conversatons - Define the problem!

SOLUTION

The engagement basis the identified business needs/priorities and timelines

SHOOT

Through effective & engaging integrated delivery with your team, duly supported by expert inputs, and required primary/secondary research!

SYNERGIZE

The engagement basis the identified business needs/priorities and timelines

Why Choose Us

1. Engagement Led By Tier 1 Industry Experts!

Each of the engagements is led by a highly experienced industry expert, who can "Walk the Talk", bring in the ground level insights (duty supported by custom primary/secondary research) and thereby, add the required value.

Tier 1 Industry Expert is defined as someone who as spent 15+ years of experience in the industry across startups/ large organizations / consulting and brings in Tier 1 education pedigree.

2. Customized Value To Your Engagement!

We do not believe in tranactional engagements. We customize and engage post identification of your specific need, basis our prioprietary 4S framework: SPOT > STRUCTURE > SHOOT > SYNERGIZE

3. Flexible Modes of Engagement!

We understand that at this stage, you need to prioritize every buck for growth. So, we mostly charge you for success of the engagement!

What Can We Do For You?

Considering Fund Raising or M&A?

We Can Help!

Get!

Getting the Numbers right!

Set!

Setting the Narrrative right!

Go!

Getting the ₹₹₹!

We Provide Informed Answer To Your Questions On Growth!

- How big is market in India & beyond?

Where can I grow next? - Is my product fitting into the customer market?

- Who are my hardcore customers? Where can I find them, and how would the customer journey look like?

- What should be the optimum pricing strategy for my portfolio?

- What new products / service offerings I can plan & introduce?

- How am I placed against competition?

- ….. and many more

Trying To Setup An Operating Process,

Please Come To Us!

- How can I setup smart goals for my firm?

- How to setup an employee engagement / performance management / compensation / other HR process for my firm. What is the optimum way?

- I want program management support for my internal strategic initiative(s).

- …… and more!

Considering Fund Raising or M&A?

We Can Help!

Get!

Getting the Numbers right!

Set!

Setting the Narrrative right!

Go!

Getting the ₹₹₹!

We Provide Informed Answer To Your Questions On Growth!

- How big is market in India & beyond?

Where can I grow next? - Is my product fitting into the customer market?

- Who are my hardcore customers? Where can I find them, and how would the customer journey look like?

- What should be the optimum pricing strategy for my portfolio?

- What new products / service offerings I can plan & introduce?

- How am I placed against competition?

- ….. and many more

Trying To Setup An Operating Process,

Please Come To Us!

- How can I setup smart goals for my firm?

- How to setup an employee engagement / performance management / compensation / other HR process for my firm. What is the optimum way?

- I want program management support for my internal strategic initiative(s).

- …… and more!

Our Team

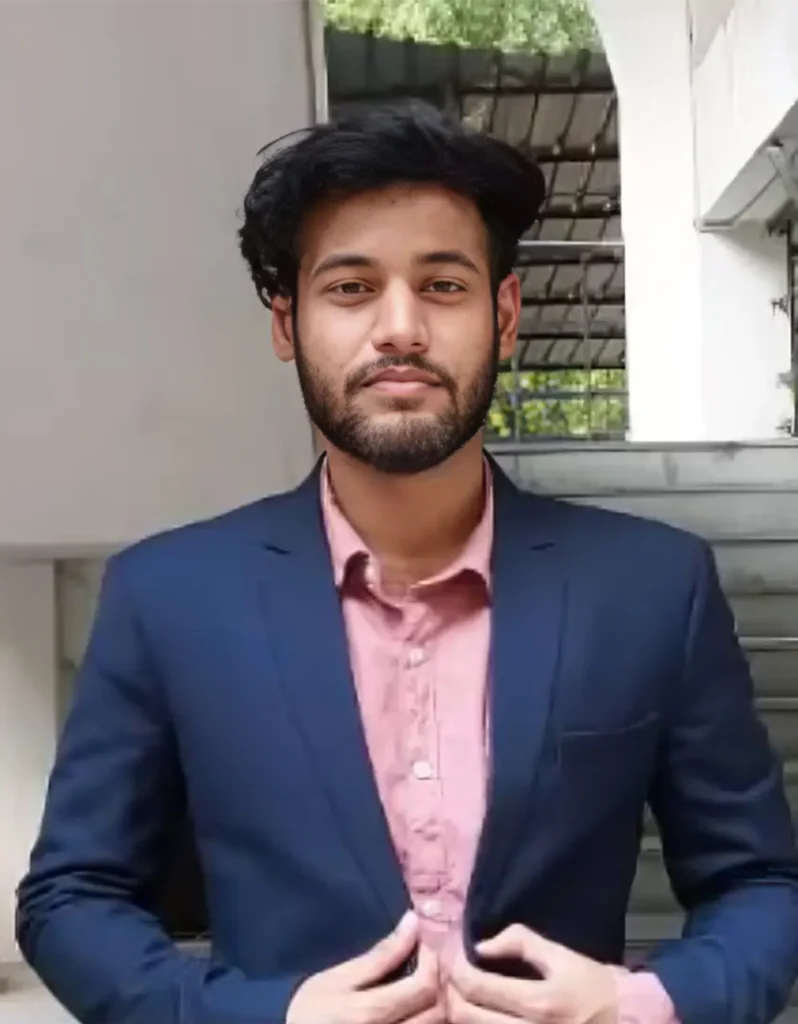

Abhishek Chauhan

The nature of engagements he has been involved in includes deal strategy (covering investment banking, diligences, and more), growth strategy, and process improvement. He has collaborated with funds, corporations, startups, and MSMEs across sectors such as ClimateTech, Fintech (including Payments, Insurtech, Lending, Wealthtech, and more), EdTech, eHealth, Gaming, Digital Advertising, eB2B retail, Agritech, EV/Automotive, D2C/Consumer, and others.

He has advised on deals worth over $2 billion and has worked with numerous startups and corporations on specific strategy engagements.

At SAMVEDANAM, Abhishek leads business development and the delivery for the Investment Banking/M&A business, as well as StrategyElevate, the Business Advisory arm of SAMVEDANAM.

Education: B.E. with Honors and Gold Medalist from Punjab Engineering College, Chandigarh; PGDBM in Marketing from SPJIMR, Mumbai; DBA from ESGCI, Paris (currently pursuing).

Md. Imran

Analyst - Investment Banking

Specializing in assisting startups with fundraising and creating Pitch Decks, Research Reports, Advanced Valuation Reports, and Financial Models. Previously worked as a consultant at 180 Degrees Consulting and has a strong background in compliance.

Focused on delivering actionable insights and financial strategies to help businesses scale and secure investment.

- Email:md.imran@samvedanam.com

Sunny Garg

He has successfully led multiple startups and established firms in securing funding and enhancing their valuations.

Sunny offers deep expertise in financial valuations, financial modeling, project finance, designing optimal debt and equity structures, running investor roadshows, and closing fundraising and M&A deals

At SAMVEDANAM, Sunny primarily oversees deal execution for fundraising and M&A assignments. He also spearheads SAMVEDANAM's early-stage fundraising initiative, PitchYourStory.

Aziz M.

Manager - Operations & HR

Aziz combines industry knowledge with strong communication and teamwork skills. His ability to streamline workflows and improve operational efficiency supports Samvedanam’s mission of delivering excellence in consulting services.

Aziz’s commitment to innovation and operational excellence continues to strengthen Samvedanam’s growth and success.

- Email:aziz@samvedanam.com

Rohit Singh

Prior to joining SAMVEDANAM, Rohit served as Head of Credit at Samba Financial Group in the UAE for 13 years. This extensive experience provided him with valuable insights into market dynamics and the ability to maintain the stability of lending portfolios across various economic cycles, including during the Lehman Brothers financial crisis, the COVID era, and periods of market growth and optimism.

He was also a founding member of a banking startup within Samba Financial Group in the UAE, where he developed the comprehensive end-to-end strategy for business continuity and market launch.

Rohit’s professional philosophy centers on evaluating the risk/reward dynamics of business opportunities and facilitating deals with this balanced perspective.

At SAMVEDANAM, Rohit leads deal origination for the Investment Banking and M&A practice.

- Email:rohit@samvedanam.com

Sakshi Thakur

Associate - Operations

Her analytical approach and problem-solving skills allow her to streamline processes, enhance productivity, and coordinate key business functions. Having worked on lead generation, corporate operations, and hiring strategies, Sakshi ensures smooth internal operations while assisting in impactful decision-making.

Her commitment to continuous learning and professional growth reinforces Samvedanam’s mission of excellence.

- Email:sakshi@samvedanam.com

Abhishek Chauhan

The nature of engagements he has been involved in includes deal strategy (covering investment banking, diligences, and more), growth strategy, and process improvement. He has collaborated with funds, corporations, startups, and MSMEs across sectors such as ClimateTech, Fintech (including Payments, Insurtech, Lending, Wealthtech, and more), EdTech, eHealth, Gaming, Digital Advertising, eB2B retail, Agritech, EV/Automotive, D2C/Consumer, and others.

He has advised on deals worth over $2 billion and has worked with numerous startups and corporations on specific strategy engagements.

At SAMVEDANAM, Abhishek leads business development and the delivery for the Investment Banking/M&A business, as well as StrategyElevate, the Business Advisory arm of SAMVEDANAM.

Education: B.E. with Honors and Gold Medalist from Punjab Engineering College, Chandigarh; PGDBM in Marketing from SPJIMR, Mumbai; DBA from ESGCI, Paris (currently pursuing).

Sunny Garg

He has successfully led multiple startups and established firms in securing funding and enhancing their valuations.

Sunny offers deep expertise in financial valuations, financial modeling, project finance, designing optimal debt and equity structures, running investor roadshows, and closing fundraising and M&A deals

At SAMVEDANAM, Sunny primarily oversees deal execution for fundraising and M&A assignments. He also spearheads SAMVEDANAM's early-stage fundraising initiative, PitchYourStory.

Rohit Singh

Prior to joining SAMVEDANAM, Rohit served as Head of Credit at Samba Financial Group in the UAE for 13 years. This extensive experience provided him with valuable insights into market dynamics and the ability to maintain the stability of lending portfolios across various economic cycles, including during the Lehman Brothers financial crisis, the COVID era, and periods of market growth and optimism.

He was also a founding member of a banking startup within Samba Financial Group in the UAE, where he developed the comprehensive end-to-end strategy for business continuity and market launch.

Rohit’s professional philosophy centers on evaluating the risk/reward dynamics of business opportunities and facilitating deals with this balanced perspective.

At SAMVEDANAM, Rohit leads deal origination for the Investment Banking and M&A practice.

- Email:rohit@samvedanam.com

Aziz M.

Manager - Operations & HR

Successfully performed hundreds of digital marketing campaign

@Samvedanam responsible for Operational Activities, Business Campaigns, Fund Raising Campaigns, Digital Marketing, SEO etc.

Worked Organizations: RedSeer, Vidhyarthi Sewa, Jyeshtha.

- Email:aziz@samvedanam.com

Md. Imran

Analyst - Investment Banking

Specializing in assisting startups with fundraising and creating Pitch Decks, Research Reports, Advanced Valuation Reports, and Financial Models. Previously worked as a consultant at 180 Degrees Consulting and has a strong background in compliance.

Focused on delivering actionable insights and financial strategies to help businesses scale and secure investment.

- Email:md.imran@samvedanam.com

Sakshi Thakur

Associate - Operations

Graduated from Chandigarh University

With a passion for learning new things complementing professional skills & adding a unique dimension to the team

Brings energy & innovative ideas in our ongoing projects

- Email:sakshi@samvedanam.com

Our Clients Speak

Lalit

Founder - TSUYO

Nitin

Founder - Navadhan

Harminder

Founder - WAYA

Hiten

Founder - Xtrawrkx

Anindya Sengupta

Founder - CGAPP

Rupan Oberoi

Founder - Amaara Herbs

Lalit

Founder - TSUYO

Nitin

Founder - Navadhan

Harminder

Founder - WAYA

Hiten

Founder - Xtrawrkx

Anindya Sengupta

Founder - CGAPP

Rupan Oberoi

Founder - Amaara Herbs